The

last few months have been happy and lazy -- relaxing with Sebastien,

eating avocados, reading tons and absorbing tons, enjoying the sunshine,

working out (please totally ask me to flex my arms next time you see

me, I have muscles!). Besides a fair amount of weddings to attend ($$

for travel/gifts and so worth it), putting down $1,200 for my half of an

apartment deposit, and what feels like flying to boston every other

week (yay!), the summer has been more expensive than it could be, but

less expensive than my previous, consultant life. And thoroughly

wonderful (and also wonderfully ending soon -- my brain wants to create,

think, and take classes again). So far I’ve withdrawn $1,500 from my

Roth accounts to help fund the summer (on top of some cash moneys I’d

saved from my job), and my goal is to keep it that way.

|

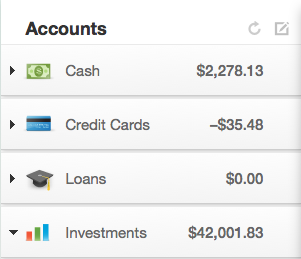

| My moneys - goodbye big credit card bills (& points!) |

Money

is taboo and talking about it can be unsavory. I actually sat here for

a few minutes and tried to figure out whether anyone would be extremely

uncomfortable or upset with the graphic I shared above. Crazy, right?

I just wanted to add some data, yet I realize sharing net worth is more

revealing in our society than sharing your sexual preferences. There

will likely be few changes in the coming years to that net worth -- just

adding a yearly $5,500 Roth IRA contribution, and of course the

wonderful growth and power of compound interest. Simple, really.

If everyone walked around with a little cartoon net worth bubble above their heads, or if everyone’s net worth was tracked yearly and available as public information, would we overspend, get into as many tight financial squeezes, or feel as alone in our money troubles? Ok, there would be a whole host of negative consequences (people being targeted for robberies, kidnappings), not to mention a completely unacceptable invasion of individual rights. So I would never want that reality. But it is interesting to think about -- if the purpose of spending lots of money on fancy clothes, cars, and houses (especially when you can’t afford them) is to gain respect and prominence through your image, would the reality of a negative net worth negate those efforts? Would we be be mostly helped or hurt by making money an acceptable and transparent topic?

No comments:

Post a Comment